Welcome to the February 2023 edition of our net worth tracker, where we track our net worth month over month. I first started tracking our net worth at the time this blog was started, which was at the beginning of September 2019. I started by creating the Net Worth Baseline report.

You can view Previous Net Worth reports HERE.

February 2023 Net Worth

Here’s how February compares to last month:

February Account Breakdown

Let’s take a quick look at what happened in February.

Cash ($3,430.35)

Monthly Blurb: This is where our paychecks get deposited. All our income goes into this account, then gets transferred to the proper accounts as set by my budget. As usual, I do the net worth report before transferring money to the appropriate accounts.

Nothing really exciting here. My wife worked a little more, and we brought in a little extra money as a result. I also earned an “extra” paycheck this month.

Investment Cash ($3,367.33)

Monthly Blurb: All of our cash left over at the end of the month is transferred here and is considered part of our savings rate.

Pretty normal for us. We had a little bit extra that we were able to transfer last month.

Remaining Cash Accounts (Emergency and Sinking Funds) ($812.81)

Nothing exciting here. Just the usual. We are just saving up for our property tax bill and HOA fees. (Yay, no more HOA fees.)

Retirement Accounts

401(k)s ($150.27)

February was a mediocre month for the stock market. The month ended nearly the same as it started

IRA (-$1,864.95)

The IRA’s didn’t fare as well as the 401(k)’s did, primarily because we didn’t add any money ourselves.

College Fund ($155.29)

Just like the other investments, the college savings fell slightly as well.

Net Worth ($5,093.98)

The markets didn’t have a big impact on our net worth in February. The primary driver was what we were able to save from our take-home pay.

Our net worth increased by about 0.5% in February.

Accessible Net Worth ($6,808.66)

Monthly Blurb: This is the money we are able to put away, not including the tax-advantaged retirement accounts.

Our income was slightly below average, and so were our expenses. Our accessible net worth increased mostly because of monthly interest and the amount we saved from our paychecks.

I still need to figure out what to do with that investment money now. Any ideas? It’s hard being patient and letting it sit there, although I think that is the right thing to do.

I want to see what direction this recession takes, especially as the housing market cools off. Is it still cooling off or starting to heat up again? Haha. It’s hard to tell. Hopefully, I can get a good deal on some investment properties.

Liabilities

Status: None, as usual. They’re a burden, so I avoid them. The cars, the house, they’re all paid for. Student loans…never used them. Credit Card debt? I only use one, and it gets paid off every month, and often I’ll pay it off multiple times per month. Just depends on how many times I think about it.

Passive Income

January was a lackluster month. February, in comparison to previous years, was great. The best February I had prior to this year was $35, and this year was over $210!

I don’t know what to think about March as I see many companies cutting spending and making layoffs. I’m just hoping that I make half as much as last year, which would be $500.

The interest rate in my savings account seems to have stabilized for the time being.

My money still isn’t making much money sitting in that “high-yield” account, now earning 3.4%, but it’s better than where it was.

That’s a lot better than the 0.4% we saw at the beginning of the year.

Saving’s Rate

I track my savings rate in order to help keep my feet to the fire, so later, I can be Gone on FIRE. As a bonus, you get a glimpse into my cash flow by looking at the income and expense rows.

Our year-to-date savings rate is below 50%, but not by much. Perhaps we can reign in our spending by just a hair and get it to the goal.

Here’s how we did this month.

Income ($8,953.09)

Right now, our only source of active income is through our full-time jobs.

This is what a slightly below-average month looks like for us.

Expenses ($4,735.61)

Our expenses were also slightly below average this month.

Here is a quick breakdown:

1) Home Escrow (965.00)

The “new” normal amount we put aside every month. (That should actually go down next month).

September was the last month paying for two houses. That was expensive, and it hurts every time I see how much it costs! Now you see what it’s like without the mortgage payment, and last month you can see what it’s like with a mortgage.

I like this number a lot better!

2) Giving ($984.84)

The usual 10% we give every month. Plus 1% that we started to give on top of that.

3) Cost of living ($2,785.77)

This includes all our bills (Gas, Electric, Water, Internet, Phone), transportation, food, shopping, car insurance, and daycare. Home insurance is paid for out of our Home Escrow savings account. Like last year, we are going to drain our dependent care account at the end of the year in one lump sum. Doing it that way is less paperwork for us.

In February, we had below-average expenses. My wife had a work conference, and there were travel expenses as a result. That was the main expense in February.

February 2023 Vs January 2023 Expenses

We don’t have daycare for one of the kids anymore, and the school is providing after-school care for free. I really appreciate that!

February went relatively smoothly.

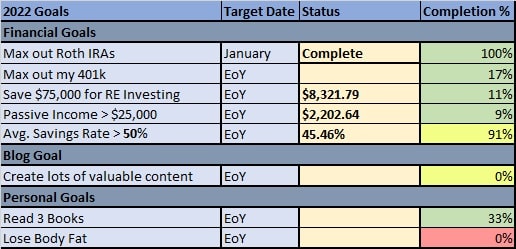

Goals Progress

Financial Goals

Aside from the Roth IRA contribution, most of the financial goals this year are year-long goals.

The Roth IRA contribution is done, and the money has been transferred to the proper accounts.

Aside from the 401k, which is on automatic contributions from my paycheck, I’m not completely sure how the other goals are going to turn out. It’s still too early to tell.

I think we’ll hit the passive income goal, but I’m not sure about the savings goal.

The savings rate goal is starting to become a thorn in my side. We’ll see if that’s enough motivation to actually reach the goal.

Blog Goal

My goal of 10 articles this year is in the works. I’ve actually been working on some content for this site other than my net worth reports! I’ll try to at least get one or two posted before the end of the month.

Personal Goals

I’m doing a reading goal again this year with the same number of books. Last year I only read 2, but I know I can do 3. I’m done with the first book. Now to read the next 2…

And then there is my physical health. I didn’t get to where I wanted in 2021, …or 2022, so we’ll continue to try again this year. I want to lose fat, and part of that is going to be by eating healthier. So far, that hasn’t happened.

February 2023 Roundup

The month of February was a good one.

I’m excited as we progress into March and see what dividends and capital gains look like for this quarter. Hopefully, I’ll get more chores off my to-do list, allowing more time for these reports and other helpful posts.

Stay tuned for next month’s Net Worth update!

FIRE Away!

REMINDERS:

- 2 big items not included in my net worth:

- House & Cars – Their value will be added to my net worth if and when I sell them.

- 2 accounts not included in the net worth total (even though they’re listed):

- 529 – This is money for my babies. Consider it their net worth summary.

- Home Escrow – This is Uncle Sam’s money. We don’t mess around with Uncle Sam and his money.

- Total income only includes our active income, which is currently our full-time jobs.