A week ago, you saw that I calculated my FI number as if my goal was FatFIRE. That number does not seem to be realistic, so I went through my numbers to see what I could take out. In this edition of determining my FI number, I’ll be aiming for more of a normal FIRE, or leanFIRE. It might not seem so lean depending who you ask. I’m not willing to sacrifice everything I can in the name of retirement. I would like to retire in comfort, at the very least. So, let’s walk through the steps again, using a budget after I’ve made some spending cuts.

For my FatFIRE numbers I used worst case scenarios. For leanFIRE, I’ll lean towards realistic, closer to average values where I can. That said, I still plan to aim for a 100% success rate when doing the FireCalc step.

Step 1: Determine current annual spending.

Let’s take a quick review of my current annual spending, then see where I can make some cuts.

The first step I take in determining my estimated retirement spending is to look at how much I spend now:

House

This number includes all housing related expenses, but the majority of that value is for property taxes. I also have HOA fees. One state I’m considering moving to in retirement is Tennessee. There I could avoid HOAs fairly easily and significantly reduce my property taxes. I could buy a similar age and similar size house, about the same distance away from an urban area, and pay about 25% of the property taxes I pay now. Let’s say that reduces my housing costs to $3,000 for the year.

Living Expenses

Cutting the budget here is going to be a little trickier. It will hurt a little as these directly affect my level of comfort. This is that very broad category into which I’ve lumped all of my living expenses. This category includes utilities, cell phone, gas and insurance for the cars, food (both groceries and restaurants), shopping, gym, dogs, travel, and all the miscellaneous things that come up. Utilities include natural gas, electricity, water, and internet.

I’m frugal already, so that makes it even harder to make cuts. Places I can’t make cuts (or I’m unwilling to) are cell phone, gym, and dogs. Places where I could make slight improvements would be utilities and food. The most improvement I could make is in gas, shopping and travel. I could spend less on shopping by really questioning the need when I go to buy an item. I could decrease gas by not shopping or traveling as much. I think I could get this category down to $10,000/yr.

Giving

Giving is a big part of our lives. I refuse to stop giving. I can continue to give my time and resources, but can save money calculating my tithe to be 10% of my income. I didn’t adjust for retirement income when calculating my FatFIRE FI number. I’ll come back and calculate that based on all my expenses, which, in turn, is the income I will take.

…After doing the math, my giving will be around $2,000 per year.

Daycare & Work Expenses

I don’t have to worry about cutting these. They’re already gone in retirement! Work expenses will go on for as long as my wife works, but her salary will more than cover them.

Step 2: Determine additional annual spending in retirement

Cutting expenses means I’ll have a lower income and that I will qualify for more tax credits. This time around, I used $20,000 as our estimated income. Going through the healthcare.gov steps ended with them telling me I would have to pay full price for private healthcare because I would qualify for Medicaid.

At this point, I think I would rather pay a little for private healthcare than be on Medicaid. I’ll have to do my research on that. To disqualify myself from Medicaid, I changed my income to $25,000 and found that healthcare will average to around $50/mo. That works out to be $600 a year.

Step 3: Determine Spending in Retirement

This is the step where we determine how much our annual retirement spending is expected to be. Let’s go through the 3 sub-steps:

A) Add up the numbers from step one and step two.

I’ll use the updated numbers here. I would like to travel more, but it looks like I can’t afford the extra $9,600 per year. Let’s decrease my travel budget to $4,800 per year.

B) Add in taxes, if necessary.

My income of $20,400 is less than the standard deduction. Therefore, I will have no taxes. I might even get a tax refund. If that happened, I would be able to give even more!

C) Adjust for inflation

I’m still going to use 3% per year. Over the course of 11 years, $20,400 becomes $28,238. I still like round numbers, so we’ll say I need $28,500 per year.

Step 4: Determine Nest Egg Value

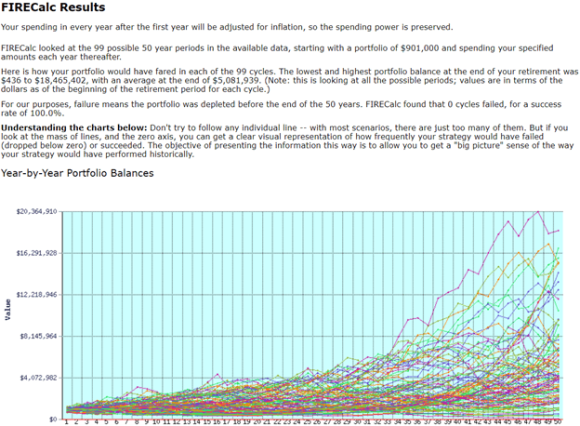

The last step is to use FireCalc and Vanguard’s longevity calculator. I went back to FireCalc to determine my necessary nest egg value and used the 2 know values of $28,500 and age 50. I put in a random number for the portfolio value for the first calculation.

On the results page, a success rate is given. This gave me an idea of how much I needed to adjust the portfolio value. I looped through this process a few times until I arrived at a 100% success rate. The nest egg value I arrived at is $900,900. That means, historically, slightly under $1 million has never failed to be able to provide $28,500 a year over the course of 50 years.

Is leanFIRE by 45 realistic?

I don’t even have to have a million dollars to retire?! Yaya! There’s a value that doesn’t make me gasp in shock. I will have to save $63,000 a year for the next 11 years and have an 8% rate of return to achieve my goal. Given our income, that number is doable. Last year we saved about $45,000 and this year we are on track to save about $60,000. I know that we can definitely save $63,000 by the end of next year with a few spending cuts. Hopefully we will get raises over the next decade as well.

My FI number, if I want FatFIRE is $2.6 million. For leanFIRE, my FI number is about $0.9 million. I’m going to set my do or die goal at an even $1,000,000. To achieve this, I’ll have to save $70,000 per year. That number is a little out of reach right now, but that’s why I like it. It will stretch me and cause me to make choices and do things that I wouldn’t otherwise do.

FIRE away!